During the XVII World Congress of Neurosurgery, a Neurosurgery book honoring Dr. Hernandez's clinical and scientific medical career was released recently.

ESTERN Medical CRO Life Sciences has become aware of job scams in which fraudsters impersonate company representatives and make fr...

We’re proud to announce that Mr. Daniel Vazquez has joined ESTERN Medical CRO Life Sciences as the Head of Clinical Trials Regulatory Advisory Board.

The ESTERN Medical CRO Life Sciences & Consulting Group, a life science clinical trials, regulatory, quality and clinical consulting firm, recently announced the launch of its clinical R&D Articles Series, an interactive knowledge of publications articles circuit featuring ESTERN most experienced clinical scientific strategic thinkers.

Dr. Jorge Estrella, President & CMO at ESTERN Medical CRO Life Sciences, was part of virtual round table at The Economist Antibodies Inc: America’s Healthcare Revolution Virtual Roundtable meeting.

This past week Dr. Jorge Estrella, President & Chief Medical Officer at ESTERN Medical CRO Life Sciences, presented as of the...

We’re proud to announce that Rodolfo Diaz has joined ESTERN Medical CRO as our Director of Business Development for our life sciences sector.

Over the last several weeks, our global nations have faced one of the most challenging times in our history. There is one thing that has not changed: our company’s continued commitment to you and our Life Science Clients, Sponsors & Partners.

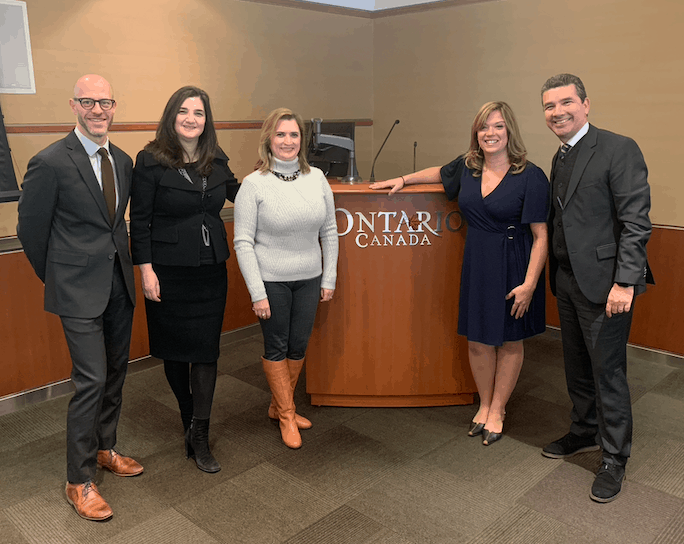

On December 2019 the ESTERN Medical CRO Senior Management were invited by the Ontario, Canadian Government Foreign Direct Investment Services Trade and Investment Division to visit the Canadian Lifescience cluster cities of the Ontario Greater Toronto Area, Mississauga, Brampton & Hamilton.

On the 05th of December 2019, the Halifax Mayor Mike Savage & Ms. Holly Bond, Director Investment Attraction Canada Partnership, visited ESTERN Medical CRO to discuss accelerating clinical research changes in the Halifax lifesciences corridor.